Table of Contents

Introduction

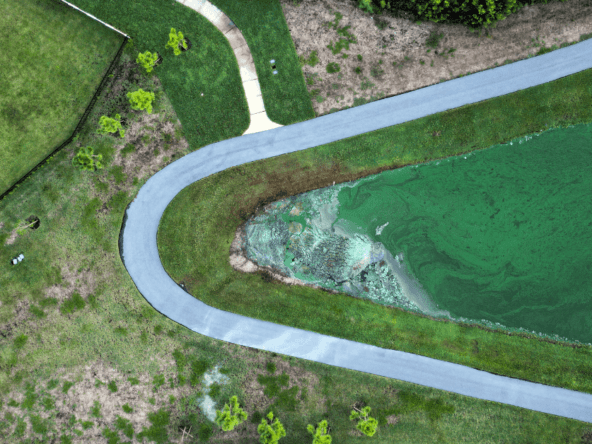

To all Wesley Chapel residents, I am here to give you very useful information about one of the best benefits of living in Wesley Chapel

The benefit is Florida Homestead Exemption.

Florida Homestead Exemption is a serious initiative, offering very good savings on your property taxes as long as you permanently live in Wesley Chapel, Florida

What is the Florida Homestead Exemption

The Florida Homestead Exemption allows eligible homeowners to exempt a portion of their property’s assessed value from taxation. This means a reduction in your property tax bill, potentially leading to significant savings each year.

Florida offers additional exemptions for specific groups, including:

- Seniors: Age 65 and older may qualify for additional exemptions based on their income.

- Veterans: Disabled veterans or their surviving spouses may be eligible for further exemptions.

- The disabled: Individuals with permanent and total disabilities may qualify for additional exemptions.

Who is eligible for the Florida Homestead Exemption

To be eligible for the Homestead Exemption in Wesley Chapel, you must meet the following criteria:

- Own and occupy the property as your permanent residence on January 1st of the tax year.

- Be a Florida resident

How much is the exemption?

Florida offers a $50,000 Homestead Exemption, applied in two parts:

- The first $25,000 applies to all property taxes.

- The remaining $25,000 applies only to non-school taxes (excluding school district millage rates).

For example, if your home’s taxable value is $100,000, you would only be taxed on $50,000, potentially saving you thousands of dollars on your property taxes each year.

What Documents are required to apply

Each person applying for the Homestead Exemption must provide the necessary documents listed below. It’s important to note that certain documents are essential for online applications:

Additionally, if you are married (including those who are married but living apart), these documents will also be required for your spouse, even if they are not recorded as an owner in our records.

- Must be a permanent resident of the State of Florida.

- Neither you nor your spouse may receive a residency-required exemption in any other state.

- Valid Florida Issued Driver’s License or Identification Card. (Mandatory for online filing)

- Social Security Number of applicant and his/her spouse. (Mandatory for online filing)

- Florida Vehicle Registration (if any vehicles owned).

- Florida Voter Registration Card (if U.S. Citizen and registered).

- If not a U.S. Citizen, a Permanent Resident Card (Green Card), or residents permanently residing in the United States under color of law (PRUCOL) status.

- Recorded Deed or tax bill verifying ownership of the property on or before January 1st of the year for which an application is being filed.

- Name and address of any owners not residing on the property.

- If you previously owned a home in Florida, the physical address or Parcel Identification Number (both may be found on a prior tax bill).

How to Apply in Wesley Chapel

As a resident of Wesley Chapel, you can apply for the Homestead Exemption through the Pasco County Property Appraiser’s Office. Here’s how:

1. Online Application: Apply conveniently online at https://pascopa.com/exemptions/exemptions/homestead/

(available year-round, but the deadline for the current year is March 1st).

2. Mail-in Application: Download and print the application form from the website and mail it to the Pasco County Property Appraiser’s Office.

3. In-Person Application: Visit the Pasco County Property Appraiser’s Office in person to submit your application.

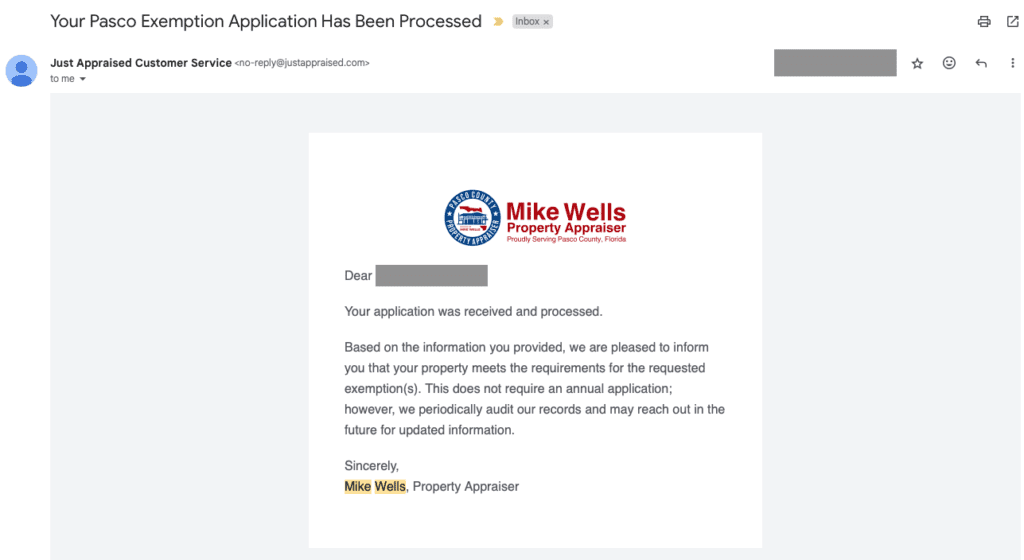

Samples of Florida Homestead Exemption Approvals

Sample Email Approval

Once your application is approved, you will receive following email

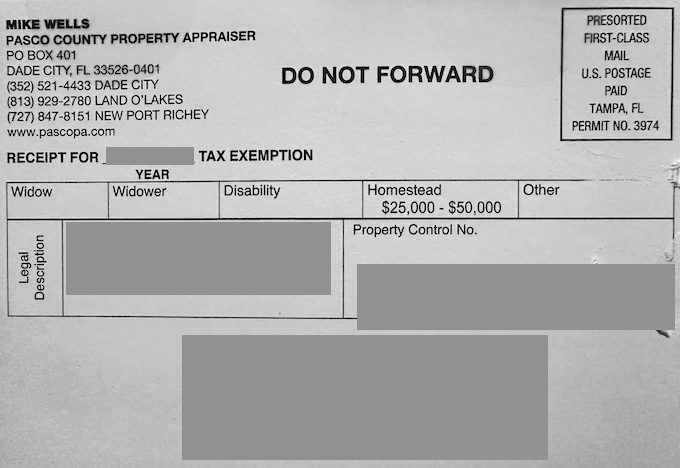

Sample Approval Card

Once your application is approved, you will receive following card into your mailbox

Don’t miss out on this valuable opportunity!

Applying for the Homestead Exemption is a simple process that can save you substantial money on your property taxes. Visit the Pasco County Property Appraiser’s Office website for further information and assistance.

Important Links

Florida Department of Revenue

https://floridarevenue.com/property/Pages/Taxpayers_Exemptions.aspx

County Official in Florida

https://floridarevenue.com/property/Pages/LocalOfficials.aspx

Pasco County Property Appraiser